unified estate tax credit 2019

For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. The Unified Tax Credit exempts 117 million.

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

If you need more information about the unified tax credit use our free legal tool below.

. The cap amount is 1206 million in 2022 up from 117 million in 2021. The size of the estate tax exemption meant that a mere 01 of. The person receiving the inheritancegift receives the full 117 million with an additional 600000 left.

The tax is then reduced by the available unified credit. The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year. For example lets say you give away 506 million in assets during your lifetime.

The extent of the benefit provided by the unified tax credit depends on the tax year in which you intend to use the credit. 202010-1e3 to conform to the TCJAs increase in the exclusion amount and changes regarding the cost-of-living adjustment. The final regulations amend Regs.

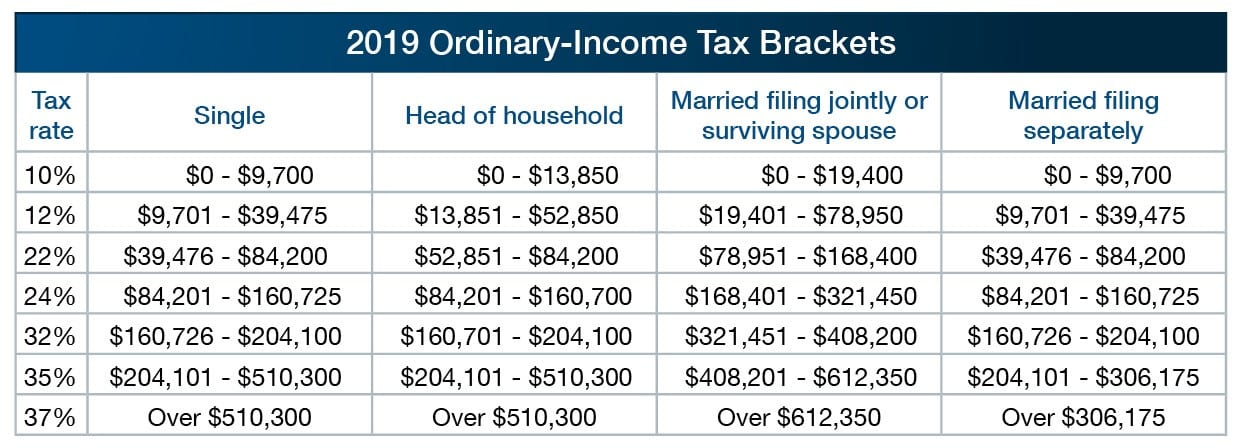

The federal estate tax exemption for 2022 is 1206 million. Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

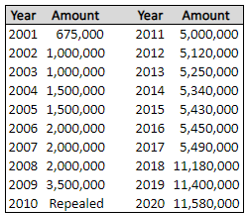

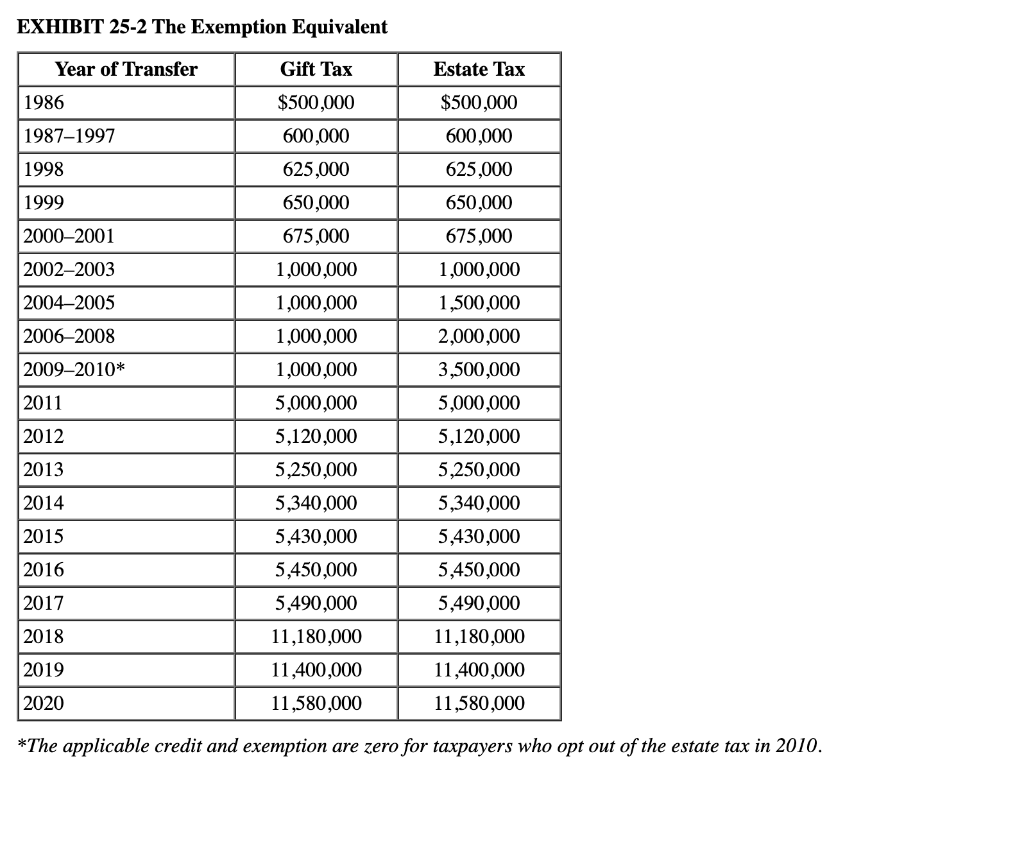

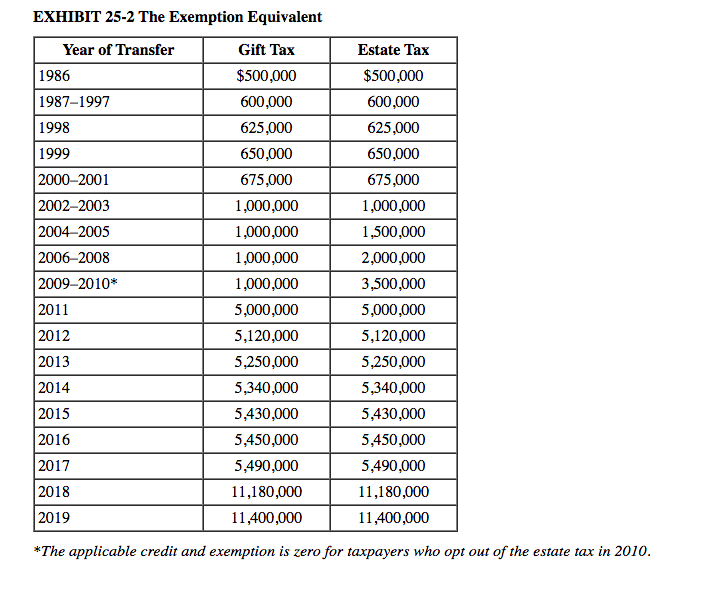

See tables here from Davenport Evans lawyers. Thus the amount for 2017 was 549 million and for 2018 11180000 rising to 114 million in 2019 and 1158 million for 2020. They also announced the official estate and gift tax limits for 2019 as follows.

It will then be taken as a credit against any estate tax owed. In addition any portion of the unified credit that is unused can. The basic exclusion is equivalent to a unified tax credit of 2117800 in 2015 2125800 in 2016 2141800 for 2017 and 4417800 for 2018.

The estate and gift tax exemption is. But all of this is more complicated than it has to be from a taxpayers standpoint. What is the unified tax credit for 2020.

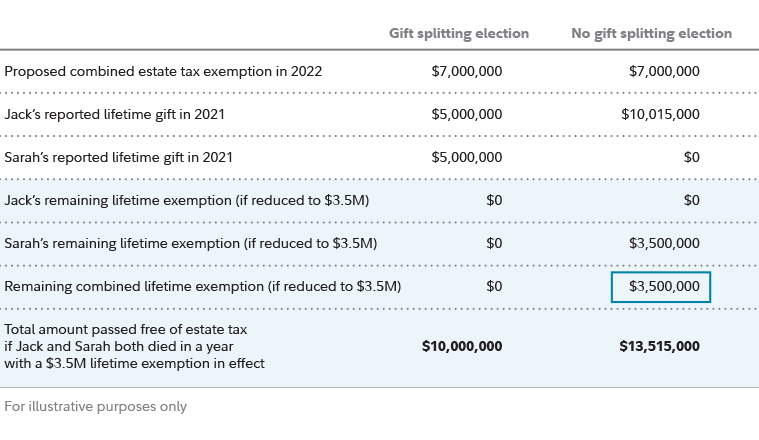

While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from 117 million to 35 million and the credit for gift taxes to 1 million. Under the tax reform law the increase is only temporary. After 2025 the exemption will revert to the 549 million exemption adjusted for inflation.

Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been increased for inflation beginning January 1 2019. The Estate Tax is a tax on your right to transfer property at your death.

That leaves 1 million above the exemption. Getty The Internal Revenue Service announced today the official estate and gift tax limits for 2019. Up from 1118 million per individual in 2018 to 114 million in 2019.

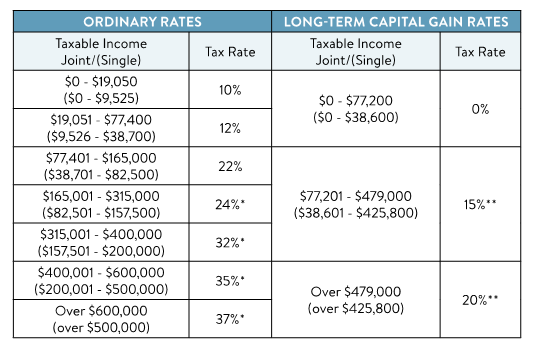

Thus in 2026 the BEA is due to revert to its pre-2018 level of 5 million as adjusted for inflation. Not over 2600 10 of taxable income Over 2600 but not over 9300 260 plus 24 of the amount over 2600. But all of this is more complicated than it has to be from a taxpayers standpoint.

That 1 million is taxed at a rate of 40 percent 400000. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. Estate Tax Credit Equivalent 2125800 2141800 4417800 4505800.

Estate tax returns are required when the total gross value of the estate exceeds the amount shown in the following table. The basic exclusion amount for determining the unified credit against the estate tax will be 11580000 for decedents dying in calendar year 2020 up from. Youd have just 7 million left of that 1206 million credit with which to.

The 2022 exemption is 1206 million up from 117 million in 2021. Is added to this number and the tax is computed. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

If a person dies in 2019 she can leave a 114. The estate and gift tax exemption is 114 million per individual up from 1118 million in 2018. A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system.

That means an individual can leave 114 million to heirs and pay no federal estate or gift tax while a married couple can shield 228 million. Which will then be subtracted from unified credit unless the gift tax is paid in the year it is incurred. The tax credit unifies the gift and estate taxes into one tax system that decreases the tax bill of the individual or estate dollar for dollar.

A unified tax credit is the credit that is given to each person allowing him or her to gift a certain amount of money each year without having to pay gift estate or generation-skipping transfer taxes. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly. Specifically the unified credit allows you to give up to 15000 to anyone each year without having to file a gift tax return form with the IRS.

Qualified Small Business Property or Farm Property Deduction. The estate tax exemption is adjusted for inflation every year. The first 1206 million of your estate is therefore exempt from taxation.

Msu Extension Montana State University

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

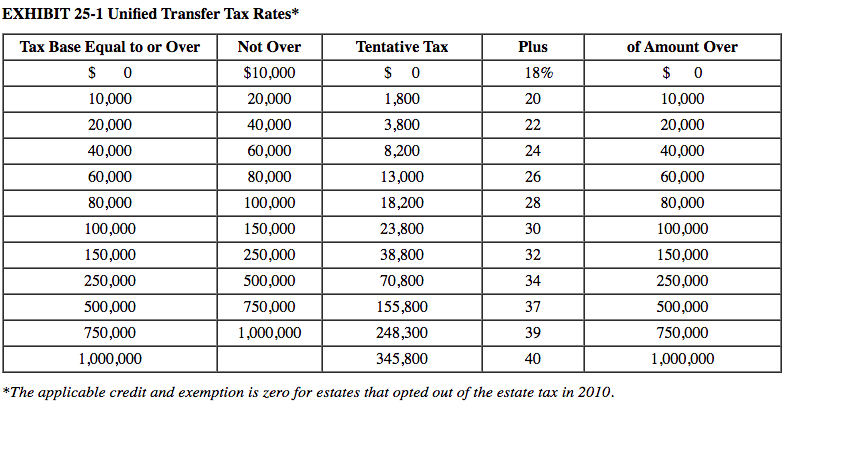

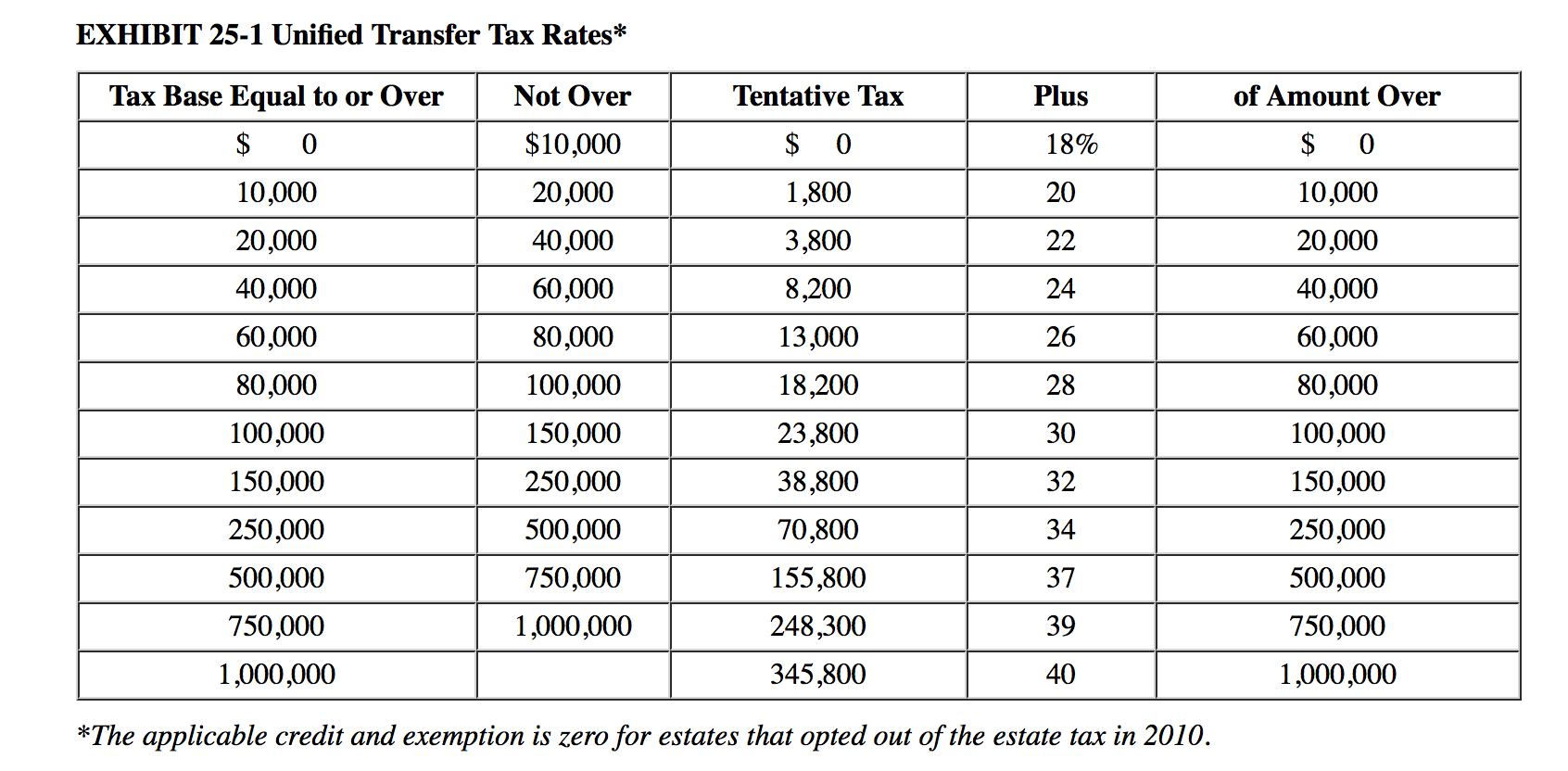

Solved Exhibit 25 1 Unified Transfer Tax Rates Plus Of Chegg Com

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is The Unified Tax Credit How Does It Change Federal Gift And Estate Taxes

History Of The Unified Tax Credit Apple Growth Partners

Solved Comprehensive Problem 25 65 Lo 25 1 Lo 25 2 Lo Chegg Com

What Do 2019 Cost Of Living Adjustments Mean For You Pya

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Solved Exhibit 25 1 Unified Transfer Tax Rates Plus Of Chegg Com

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Planning Strategies For Gift Splitting Fidelity

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com